|

|

|

|

|

by Giancarlo Abbate

|

|

Preamble: This post is the translation of the original Italian article, written by the author 2 years ago for the Italian blog iMille.org, thus anyone who will read it should keep in mind the following considerations: The analysis, point of view, references are mostly concerning the Italian situation, even though may often have a more wide and possibly general value. As often it is the case, the translation in a different language is a difficult task, more difficult than entirely rewrite the paper, owing to the different syntactic constructions that may lead even to a different way of thought processing. So, please forgive the unavoidable roughness that you will face while reading the text. Some sentences may look outdated or no more applicable, but I made the choice not to change any sentence in the text in order to give a clear picture of what my ideas were when I wrote the original paper. Any reader can compare them with the present situation and decide which are still valid, if any, and which are not. |

|

|

|

Time passes, year after year, and the economic crisis is still there and distresses the life of Italian people. However, if we look a bit further, we can easily realize that the crisis is not just our own affair, neither only an issue of Mediterranean countries. It is more likely a global problem. It concerns also the rich North and Middle Europe countries, Japan, even US and BRICS. During the last years, somebody may have got the illusion to have found the right recipe to defeat the crisis, at least for their own countries (… and now, it’s a problem for other people, not for me anymore…). Probably, they were wrong. Many, if not all, begin to doubt about the effectiveness and continuity of their initial successes, despite the great variety of recipes and different economic strategies adopted. Abenomics seems sinking under the tsunami stroke, the accident at the Fukushima plant, and the huge Japanese public debt. The American shale gas that should have flooded Europe, after causing a new deal of the US economy, doubles its price in six months and cannot be exported anymore. At Wall Street, the bull is still running but the doubt of another financial bubble that will soon or later burst is always there. The hard and strong German economy is hanging itself at its own inflexibility. The whole Europe slows down. India and Brazil lower their growth estimates. Governments and intergovernmental bodies agitate, analyze, take actions, strategies, and corrections, but the spectre of the crisis is still haunting us … and not only in Italy. Well, how and when will we get out of the crisis? The more time goes on, the more doubts and worries run over economists, financiers, politicians, and all the people who believed to have the good recipe, or most of them. I can’t claim to be able to outline a brilliant analysis of Italian and world economic situation, because I lack an academic background in economics. Neither I can propose strategies to get out of the current crisis. Nevertheless, I like reading other’s analyses and comments, check them, and give an evaluation not as an expert on the subject nor as total ignorant, but as a man of science, and a physicist in particular. As editor of iMille, I would also like that these “external” opinions could be food for thought and add something to the debate among the various true economics experts in the editorial staff and readers of this paper. |

The causes of the crisis |

|

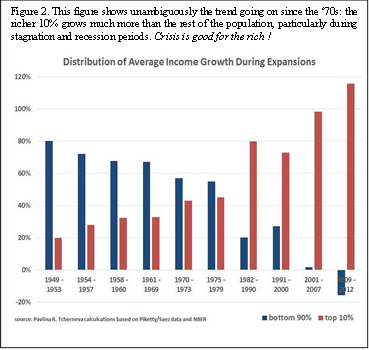

The gross world product is almost entirely generated in capitalist-economy countries, whose rules are followed by China as well, even if in its peculiar and sometimes controversial ways. Many economists have been lately highlighting differences between (a) “ethic” capitalism, that is: I am now stockpiling capitals to generate wealth (for me and for others) in the future, where growth is based on resources available today which are thus invested; and (b) “egotistic” capitalism, that is: I use current resources for my present welfare and suppose development basing on debts, hoping to be able to settle them in the future. Both forms of capitalism expect, and are based on, perpetual (or almost perpetual) growth, they have some positive aspects, and can be criticised for others. However, it seems clear that egotistic capitalism is far less sustainable and must call for spots or moments of crisis (bubble burst). We witnessed public and private debt growing much more than GDP during the last 30 years, in Italy and in most of the world. That is a clue that since the 80’s form (b) of capitalism prevailed, but also that we should have expected occurrences of crisis in many countries and even a global crisis such as the one triggered in the USA during 2007, with which we are still struggling. This time is different is the title of a best-seller accurately overviewing economic crises, both historically and geographically (subheading: Eight centuries of financial folly; authors: Carmen M. Reinhart & Kenneth S. Rogoff). The authors assert that the four words in the title (this time is different) are the biggest error made by politicians, opinion-makers and economists during development stages while ominous signs might point to a crisis: actual situations might be completely different, but crisis signs are similar and easily noticeable. These signs are (almost) never accounted for, either because of ignorance (I cannot acknowledge the signs) or arrogance (I acknowledge the signs but I think I can control the situation because I am better than my predecessors are, I have better tools, and better technology). The strongest and most common of these signs is when a nation’s debt, public or total, passes a reasonable threshold value. Debt grows much faster than GDP. Financial economy grows faster than real economy, the median household income, that is the income of the average family, gets further away from the mean value (see Figure 1). |

|

|

|

|

|

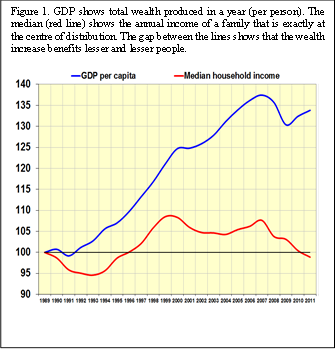

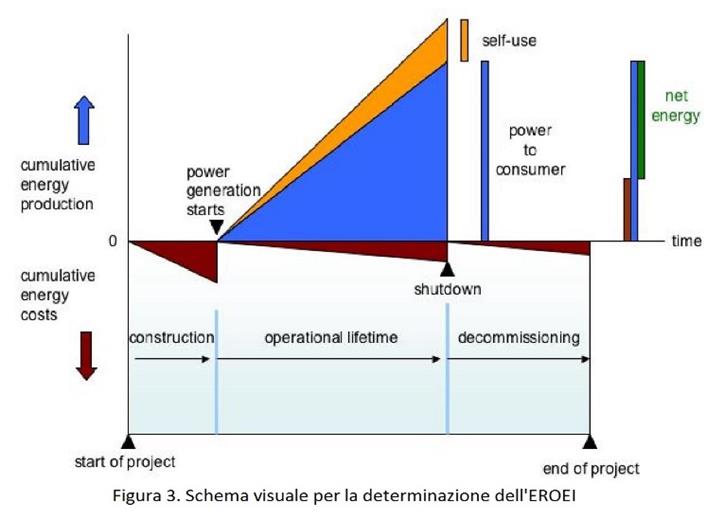

The partial shift of industrial production, real economy, to areas and countries where labour cost is less expensive while keeping consumption of goods in the rich countries, also contributes to debt growth. The by-product is two-sided: capitals move from a country to another; the gap between the rich and the middle class in wealthy countries grows, with a substantial shift of the masses toward poverty (Figure 2). Ignorance leads to a lack of timely acknowledgement of the unsustainable process going on. This is way more likely if economical data get disguised, getting them dressed up and displayed in a non-disturbing way. For example, inflation value can be altered, without committing any crime, by substituting key goods on which it is calculated; GDP can be “pumped up” with non-marketable services, unemployment data can be lowered by purging the total of people not looking for a job or people with “mini-jobs” with which you can’t make a living anyway. A consequence of behaviours like these is postponing possible remedies, necessary to a “sustainable” development of economy, thus letting the bubble grow bigger, which will, instead of deflating, vehemently burst causing damage. Lastly, there is another aspect, energy availability, which, while is considered important or even fundamental by all the economists, or most of them, is often not recognised as peculiar and prevailing. Energy is deemed a good, a basic commodity like wheat, iron, rubber, to which market appoint a price depending on circumstances. But some economists, as a number of the Economist’s “Buttonwood’s Notebook” or Tim Morgan, former lead researcher for Tullet-Prebon, assert that the true economic equation is wealth = energy. Wealth corresponds to the totality of available resources, and in the end every “resource” (house, car, garment, food, etc.) corresponds to the energy necessary to obtain it (to be clearer, also materials, every kind of material, be it a piece of bread, a cotton shirt, a brick or a plastic laminate, has an intrinsic value corresponding to the energy spent in its production process, from sowing to retail in the case of bread). Giorgio Nebbia devoted most of his academic activity and opinion-maker efforts to this idea, and some historical references can be found in a short article from 1992 (reported online in 2012 here)*. In his opinion, money represents a beneficial convention for transactions, like “chips” in casinos (generally speaking and in long terms this is true; for specific times, places or objects, the two quotes, energy and money, may diverge). As Tim Morgan said in his very interesting pamphlet “Perfect Storm”: “Economic problems will remain insoluble for so long as policymakers concentrate on monetary issues rather than on the ‘real’ economy. We go further than this, arguing that the physical economy is, in essence, an energy system or, to be somewhat more precise, a surplus energy equation.” Wealth=Energy What is energy surplus and how can we measure it? If everything is energy, in a physical way of speaking, not as in Indian mysticism, then to get energy from primal sources it is also necessary to spend some energy, some obtained energy is to be invested to obtain further energy, the remaining part (the surplus) can be used for our needs, our well-being, it is thus our wealth. A useful concept, formalised in this article by C. Hall in Science of 1984, is EROEI, which I already treated on iMille here and here. EROEI, Energy Return On Energy Investment, the ratio between energy obtained and energy spent to obtain it, is a simple concept, akin to ROI (Return On Investment) used by economists, but its calculation for each single source and/or energetic technology is prone to different interpretations, particularly because of the uncertainty in the evaluation of the denominator, so it is often provided as a range and not as a specific value. |

|

It is nevertheless an essential tool to evaluate how much wealth can a specific source/technology supply (Figure 3). |

|

|

|

It is obvious that a source must have an EROEI>1 in order to provide wealth, that is energy surplus, and it is also clear that well-being of a society grows higher the bigger the EROEI of its available sources (technology has a key role too, of course). Morgan estimates an EROEI>10 as necessary to support our post-industrial society well-being (society of knowledge), Hall estimates this threshold to be EROEI>14 (the art level, according to his evaluation). Therefore another reason (neglected in the book of Reinhart/Rogoff, but pivotal in Morgan’s) which relentlessly brought us to the current global crisis is the waning of average EROEI (weighted average) of every energy source during the last 30 years of 20th century, a waning which continued, and probably got faster, during this century. Morgan concludes “This time is different” but not in the naively optimistic sense that this time we are not going to get into a crisis, but in the opposite, pessimistic sense that this time we are not going to get out of it. Literature offers many accurate analyses of energy sources, and especially of their EROEI even if with the aforementioned uncertainty, it is thus possible to get an impression of how much surplus each of them can yield. |

|

a) Among fossil fuels only coal gets above the growth threshold (according to some studies natural gas does too, if conveyed with gas pipelines). China, like Germany and Denmark, is relying increasingly on coal as primary energy source (used also to manufacture photovoltaic panels that inconsiderate public subsidies made so common in our fields). |

|

b) Hydroelectric is today the only renewable source with a very high EROEI. Unfortunately, there are geographical limitations for hydroelectric plants and it is hard to figure out a significant expansion. Energy from wind turbines gets above the threshold, according to some studies, only in specific geographical areas (not in Italy). |

|

c) Nuclear has very conflicting estimates of its EROEI but it is very unlikely it can reach values much above 10 (in Italy this technology is banned because of the outcome of two referendums). Nuclear fusion plants will (perhaps) be matter of next century and it is pointless to linger on them now. |

Conclusions I |

|

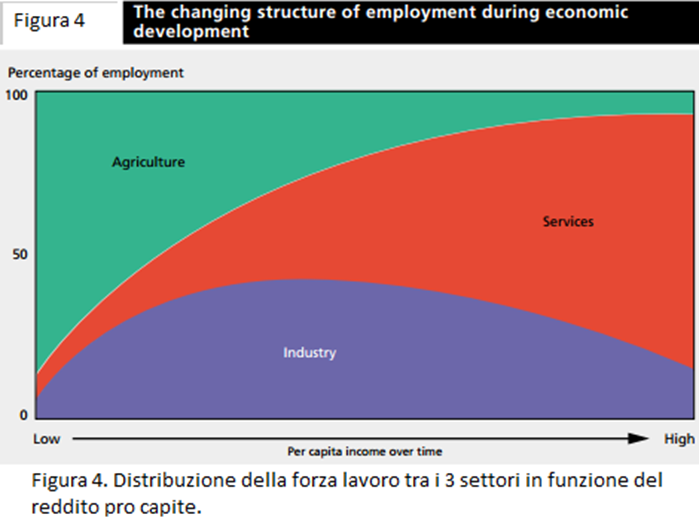

Tim Morgan and many other economists affirm that we have been living for more than 30 years above our possibilities (that is above the available energy surplus) and that it is not possible to postpone any longer the settlement of our debts. We must then adapt to a future of poverty and/or mind the limited resources available to us, and their regeneration times, if we do not want to face a collapse (Jared Diamond, Collapse). There are many ways to adapt to a future with fewer resources for the humanity. We can get a clear indication from historical and geographical analysis of the relationship between wealth and number of agricultural workers. Figure 4, extracted by World Bank data, shows the trend of occupation in the three sectors, agriculture, manufacturing, and services, as a function of GDP per capita. |

|

|

|

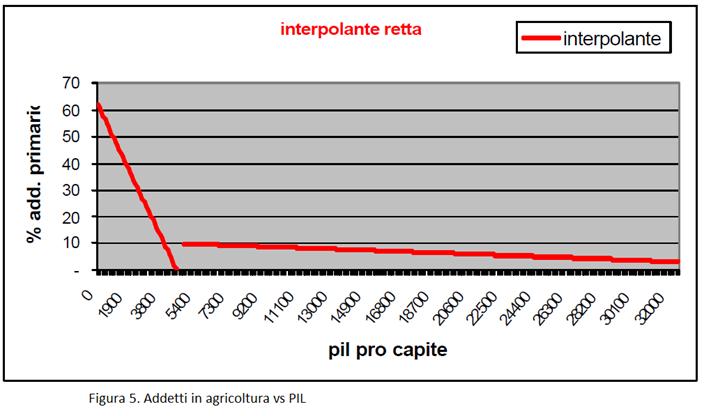

The percentage of workers in the primary sector (agriculture) decreases, in every nation and in every historical period, as GDP per capita grows. Thus, GDP reduction, or rather economic recession, can be read not only in data from central institutes of statistic (or central banks) but also in data from Confagricoltura (Confederazione Generale dell'Agricoltura Italiana, confederation of Italian farmers). A scientific work by A. Ferro and G. Raeli of University of Verona, based on data from Maddison’s Project, University of Göttingen, after many tries to get to an analytic function to describe the dependency employed-in-agriculture vs GDP, gets to a simple and interesting conclusion showed in the graph below. |

|

Figure 5 Percentage of workers in agriculture vs GDP per capita (in US$) |

|

|

|

The best curve fitting experimental data, Maddison’s data, is a straight line, rather two straight lines both with negative slopes but drastically different. The switching point between the two straight lines coincides to a GDP per capita of about 5000 $, reached in Western Europe in 1950 and in the USA in 1934. What does this trend mean? First of all, as it is obvious to expect, that the share of humanity involved in food procurement, for themselves and the others, diminishes as their work’s efficiency grows (GDP growth). Then, that in a specific historical moment and in some countries a new event happened, something that allowed efficiency growth (of GDP per capita) in a very fast way up to values unconceivable before. Some identify this quid, this something, as the prevalence of exosomatic energy use, i.e. from sources and technologies external to men, in comparison with endosomatic energy, that is based on human work. This exosomatic energy is but that energy surplus that only sources with EROEI>10 can supply in appropriate quantity. The reduction of global EROEI, namely of the world “energetic mix”, is a fact verified for more than 40 years and we are now approaching the well-being threshold, being it 10 or 14 is not paramount. Morgan and others think this decline is inexorable, that the various diverse economical recipes to oppose the crisis are pointless. In their opinion, technology will not be able to help much because if there is lack of wealth, that is energy surplus, even with a better efficiency all we could do is mitigate and slow down the escalation toward poverty. The forthcoming destiny of humanity is going back to a situation in which everyone procures food for themselves and their family. |

Conclusions II |

|

I wouldn’t be so drastic and catastrophic. I really like concepts and analyses of Hall, Nebbia and Morgan but, as a physicist, my opinion is that interpolations are tools that can be accurate and really useful to study natural phenomena and probably human, economical and social too. Nevertheless, appointing the same degree of reliability to extrapolations, based on previous interpolations, is wrong and can lead, and actually many times it did, to uproarious blunders. We have to study, interpret and understand phenomena past and present, not to give up and be ready to what will unavoidably happen, but to look for an actually feasible way out, with a lamp (previous knowledge) lighting up our path, saving us the risk of taking dead-ends which would just drain our strength not leading us anywhere. Morgan does not believe in the marvellous abilities of technology, in a passage of his, one could read: “To expect technology to provide an answer would be equivalent to locking the finest scientific minds in a bankvault, providing them with enormous computing power and vast amounts of money, and expecting them to create a ham sandwich.” Morgan is wrong. He is wrong in the introductory statement and so the rest does not make sense. Our group of scientists is not closed in a bankvault, it is instead on the Earth. While it is true that fossil resources are limited, it is also true that there are energy sources almost inexhaustible on Earth surface and in the atmosphere surrounding it. Solar energy reaching the Earth is several orders of magnitude above global humanity needs; it is “renewable” and available for free. We need to find a way to convert it into usable energy, generally electric energy, by spending just a small share of the energy it can yield (high EROEI). Nowadays, we still do not know how to do it, but we cannot rule out a future solution. The EROEI of today’s photovoltaic technology is incompatible with our well-being level, and worldwide subsidies made it artificially convenient with huge investments; this proved beneficial only to the investors themselves, and did not help research aimed toward a more efficient technology. My optimism leads me to think that we will nevertheless obtain such technology. Perhaps based on organic semiconductors, or maybe on graphene, or something else, but we will get to it. When? Surely not in a couple of years, but the more resources get invested in R&D, the higher the probability that we will reach the objective and shorter the required time. But another way, more effective and close, is available to us. We know that part of solar energy is converted in wind energy. Wind power is renewable too, that is inexhaustible, free and without harmful emissions (if dedicated plants can be realized using this very energy). Moreover, it is obtained as mechanical energy, which we can easily and very efficiently convert into electric energy. We just need to go where there is plenty of wind. We are doing this since several decades by installing wind turbines on tall support towers, not without the ever-present controversies. Potential, problems and possible development of this technology are well known. Wind power’s EROEI is compatible with our well-being level but unfortunately only in specific geographical areas (e.g. Denmark, the Netherlands) where wind is strong and blowing for a significant amount of time. Land orography (hills and mountains) magnify the braking effect of Earth surface on winds, therefore the available amount of useful wind averages between 1000 and 2000 hours per year (a year consists of about 8800 hours). This lowers EROEI of wind turbines, often under the threshold value of 10. Two solutions have been proposed to overcome this problem: a) build offshore wind towers; b) build taller wind towers. In both cases, the increase in energy output corresponds to a proportional (or even bigger) increase in costs, namely invested energy, leading to a lack of the necessary, and hoped for, EROEI growth. I posted an article on iMille, in which I described another way to go and get energy from wind where there is plenty of it: at high altitude over 500-600 metres above the ground. Wind is not slowed down by ground friction at such altitudes, blows faster so it conveys more energy, and is steadier thus allowing energy production for 5000-7000 hours per year in most land mass. This technology, which we can call High Altitude Wind Energy (HAWE), could have EROEI values much above the well-being level with industrial-scale plants sized at MW order of magnitude. I said “could” because such a plant producing and selling energy on the market does not exist yet, but the concept is neither “science fiction” at all (nothing like E-Cat madness, to be clear) nor megalomaniac. Scientific activities and industrial researches on HAWE are now under way in about sixty among small and medium-sized enterprises and big institutions. About ten of them produced working prototypes (reaching 50-100 kW of power or slightly more). An industrial machine in the MW range is currently being developed thanks to a ‘joint development agreement’ between a small enterprise in Turin, Italy (KiteGen Research) and an industrial behemoth from Saudi Arabia (SABIC). This technology is one of the most promising candidates, if not the best, that our society of knowledge has in order to escape the grim prediction of Morgan and the decline followers, also because of the time needed for technology readiness. Yet it appears still unknown to most of policy-makers and opinion-makers, and the few public discussion it generates (on the internet as well) are all too often restricted to pointless technical disputes (is it better with one or two wires? Fully automated or human-controlled flight?), in which no more than some tens of people take part, at best. My fellow editors of Energy & Environment section of iMille too, after deeming it very interesting, appear not actually interested in looking further into the most relevant aspects and details of it. We are facing important, fundamental choices and we must take decisions. We cannot look the other way and keeping on delaying action, leaving the problem to our heirs. Do we want to keep on exploiting every limited resource of this planet for 20, 50 or 100 years until the collapse? Do we want to resign to a reasonable way to decline and poverty? Do we want to keep on being amazed that the crisis is not passing and seems to go on forever? As long as I can, I will be looking for another way, a sustainable growth, the control of population increase, an economically feasible transition from fossil fuels to renewable energy sources, prioritise research and development over the often disproportionate and counterproductive subsidies and incentives. |

|

Is there any light at the end of the tunnel? Only if we light up a lamp and try to move our steps in the right direction! |

|

|

|

*Note: A quote from that article by Nebbia: “production and use of goods are linked to matter and energy flow, starting from nature, and returning to nature: a circulation nature-good-nature, N-G-N. Depletion of resource reserves and pollution depend on said flow.” This is good food for thought even if one does not completely agree with him. |

|

**Figures 1-4 were found on the internet: Figure 1 washingtonpost.com; Figure 2 cigionline.org; Figure 3 eoearth.org; Figure 4 worldbank.org. Figure 5 from A. Ferro and G. Raeli here. |